eeSea trade lane review: Far East – West Coast North America

The shipping industry is entering 2025 with significant shifts in alliance structures, shaping the Far East–West Coast North America trade. With Premier Alliance and Gemini Cooperation coming into play, plus factors like tightened U.S. tariffs, Lunar New Year blank sailings, and post-2024 rail disruptions, the first quarter promises both challenges and opportunities. Destine Ozuygur has dug int o all the details, and shares them in her newest update.

Key Takeaways:

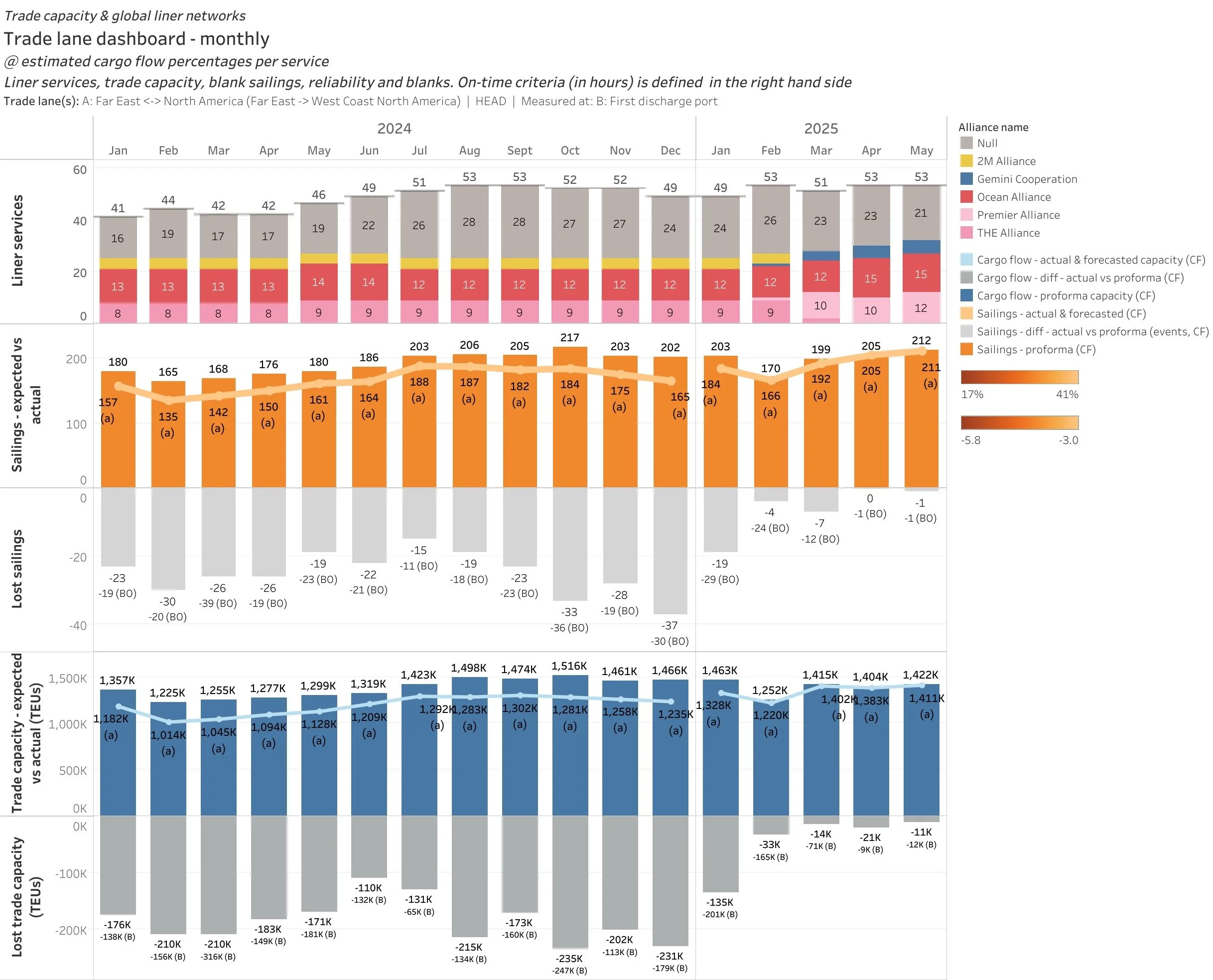

February will see a dip in planned capacity, but actual delivered capacity should remain stable in the following months.

New services are still maturing, making accurate forecasting a challenge.

MSC maintains a strong West Coast presence, despite going solo outside of alliances.

Schedule reliability remains a concern, with delays, strategic blank sailings, and port omissions already in play.

Some new services bear little resemblance to their predecessors, while others have been optimized for efficiency and reliability.

February will temporarily spike to 62 unique services, though this doesn’t translate to a rise in capacity, as service transitions create temporary gaps. By March, capacity should normalize to pre-transition levels.

This is just a snapshot. For the detailed service restructures, delays, and evolving carrier strategies, check out the full article, and dive further into our live data: https://app.eesea.com/news/trade-lane-review-far-east-west-coast-north-america